Fired Up!

Biden’s loan-forgiveness initiative makes solid strides toward affordable secondary education, yet fails to expand its accessibility.

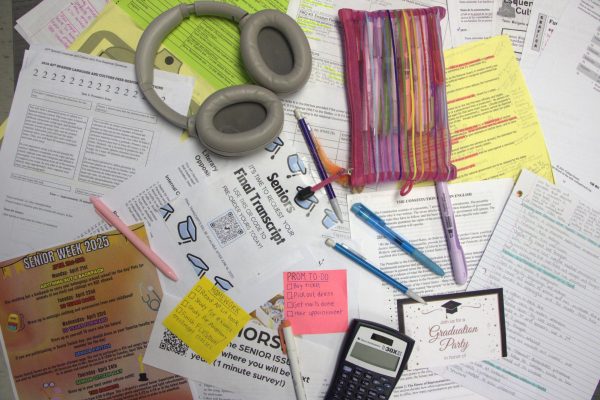

photo by Bethany Barker

As tuition prices continue to climb, those who couldn’t afford to go to college in the first place –those who couldn’t afford to take out loans – are always left behind, while politicians continue to turn a blind eye to the actual issue. Biden’s plan is no different.

When college graduates called on president Joe Biden to ease the burden of student loans, he responded. On Aug. 24, he announced a three-pronged plan that would provide up to $20,000 in loan cancellation to students who received Pell grants, and up to $10,000 for everyone else. If passed, the plan could grant Americans thousands of dollars in savings. Future college students should be celebrating, right?

Wrong.

When politicians talk about postsecondary education, student loans are always the target of their policies, but it shouldn’t be. As tuition prices continue to climb, those who couldn’t afford to go to college in the first place –those who couldn’t afford to take out loans – are always left behind, while politicians continue to turn a blind eye to the actual issue, and Biden’s plan is no different.

According to a report from the Education Initiative, the average cost for four-year college tuition increased by 31.4% in only 10 years, despite colleges’ efforts to lessen the burden through scholarships, grants and financial aid. This trend hits low-income students the hardest. According to the Lumina Foundation, 95% of colleges are unaffordable to lower income students. Biden attempted to address this glaring inequity by broadening eligibility for those who received a Pell grant–a subsidy given to those who demonstrate significant financial need– but the addition does nothing to address college tuition costs currently running rampant.

The majority of college students are loan-dependent, meaning that if it weren’t for federal student loans, they would not be able to afford tuition prices. However, these loans become increasingly accessible, allowing students to take out more money, and colleges are given the opportunity to raise their tuition costs. In forgiving the loans that former students already have, Biden’s loan forgiveness plan gives colleges yet another excuse to take their prices up a notch. Therefore, the only solution is to cap student loans, forcing colleges to adjust their prices to amounts that students can reasonably afford.

Capping tuition prices is the only reasonable way forward, and future policies should reflect that. A college’s affordability does not ride on whether or not a student is eligible for loan forgiveness, it rides on whether the average student can afford to take out those loans in the first place. Students are often made to think that attending a university is required to create a stable living, yet their ability to do so shrinks every day. If college is to remain a part of everyone’s future, it should be made affordable to everyone.

Your donation will support the student journalists of Hagerty High School. Your contribution helps us publish six issues of the BluePrint and cover our annual website hosting costs. Thank you so much!